Jump

I like to say that life is beautiful because it's unpredictable. Uncertainty is intrinsic in life, and there are always factors outside our control. Yet, we have some degree of maneuverability on a few variables. By playing with them, we can modify our exposure to the possible outcomes. From this assumption derives the idea that we can influence the probability of events happening in our lives, both negative and positive ones, as explained in this post.

Elaborating on that, one is capable, to some extent, of choosing how much uncertainty about possible outcomes to put into their life. Recently, I came across a video by Howard Marks on risk. Being an investor, he uses monetary metrics in the video, but broadening the perspective, everything can be seen as a metaphor for assessing risk when making choices about careers, social life, family, etc.

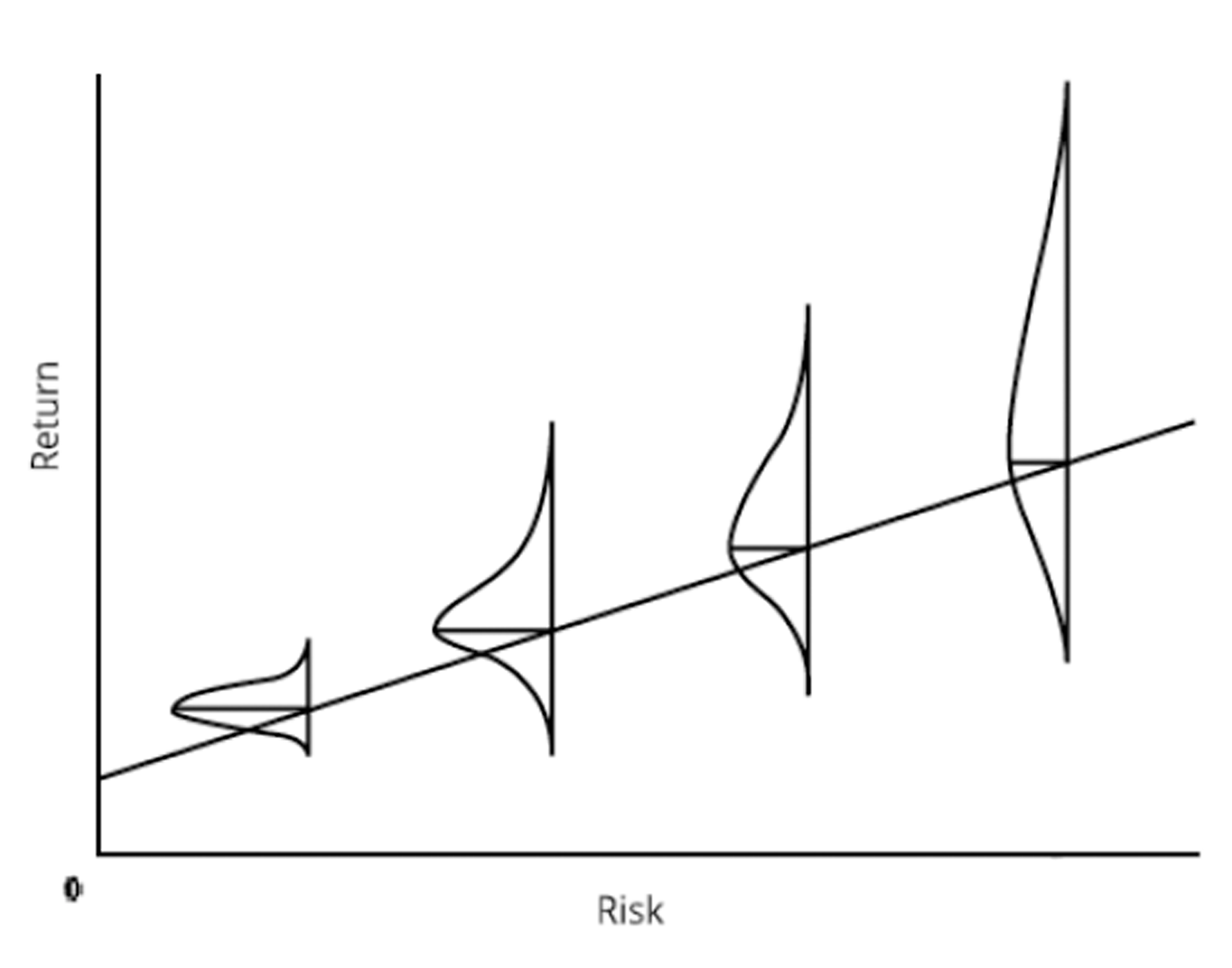

The first takeaway is that risk stems from the possibility of different outcomes after any action, which are discrete situations that can happen. Hence, they can't be fully described by metrics like expected value, the same way someone can't have 1,5 children. Instead, one can estimate risk by assessing the relative number of favorable options, considering them as discrete outcomes, and evaluating the entity of negative ones. The key lies in the distribution of those possible outcomes. For instance, exceptional investors modify the probability distributions such that they are biased toward the positive, resulting in superior risk-adjusted returns, as depicted in the graph below.

The second takeaway is that any safe asset can become risky if the price goes too high. An analogy with career decisions is that an industry can be very promising, but if too many people flow into it, one can end up with even more competition than traditional ones.

Finally, there is the risk of not taking risks. The missed opportunities are easy to accept because we rarely realize what could have happened, but our benchmarks should include them.

I decided to write about risk because it is what has led me to my recent decision to quit the promising and enjoyable role of Founder's Associate. I try to apply as much as I can of what I write, and the lifestyle of that kind of job implied a long-term health risk by not being able to do routines necessary for my well-being.

It was a difficult move, and as Howard Marks puts it:

Human nature makes it hard for many to accept the idea that the willingness to live with some losses is an essential ingredient in investment [or life] success.

Still, I have some calculated risks to take in the following months. Stay tuned; there is an industry that I deem undervalued, and I want to throw myself into it.🪂